Buy high, sell low. Wait, what? That’s not what you’ve always been told, but it could be what you’re doing. Let us explain.

Everyone says you should “buy low, sell high.” The problem? People end up doing the opposite. We feel most confident when the market is hot and tend to sit on the sidelines when it cools, because we’re worried.

The ups and downs of the market create volatility that is incredibly difficult to time. That’s why it’s time in the market, not timing the market that typically matters most. Savvy investors and the wealthy know that dollar cost averaging provides one of the most reliable ways to build wealth over time. In dollar cost averaging, you invest the same amount on a regular basis regardless of share prices, making your investment more efficient and potentially reducing your stress level.

Here’s an example.

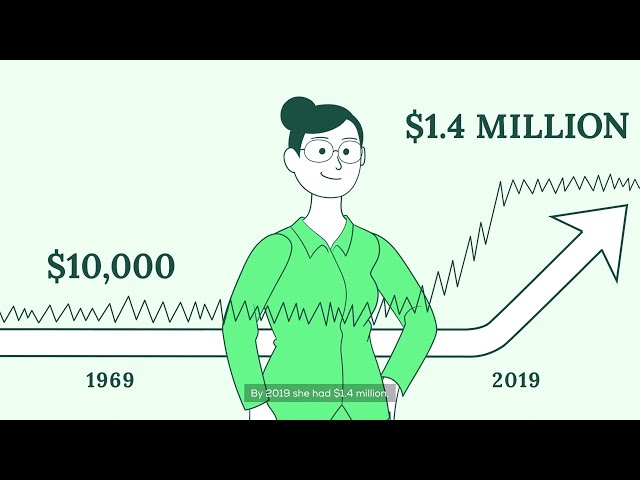

Sandra invested $10,000 in the S&P 500 in 1969 and didn’t touch it. By 2019 she had $1.4 million. Mitch made the same investment in 1969 but he tried to time the market. He pulled his money in and out and ended up missing the markets 10 best days. Mitch only had $680,410 in 2019. And, in Mitch’s defense, it was really easy to miss the best days because 7 of the 10 them occurred within 2 weeks of the 10 worst days.

The lesson?

If you invest based on how you “feel” about the market you may miss the best days and could cost yourself hundreds of thousands in returns.

That’s Why…

We urge you to consider purchasing a Variable Universal Life policy now and create an opportunity to build generational wealth for yourself and your family.

This innovative insurance policy features a growth component with no floor or ceiling, so your value moves in line with the stock market over time. Oftentimes, people own these policies for 30+ years and build generational wealth. You can use this for college tuition for your child, long-term care, or that vacation home you have always dreamed up. All while taking the worry away by knowing your family will be protected after you're gone.

Key Benefits of a VUL

- Flexibility

It’s your policy. That means you can access your policy’s cash value*, decide to dedicate additional funds towards that cash value at any point, and choose where your money grows.

- Protection

Get lifelong* coverage with the added benefit to protect you and your loved ones after you pass.

- Tax-Efficient Growth

We offer VUL policies that allow you to grow your premiums in funds such as S&P 500, REITs, global funds, mutual funds, and many others. You can access your cash value and tax-free growth as long as your policy is in-force.

*note: oftentimes, policies last until age 121 (need a better disclaimer here for sure just wasn't sure what it could be)

*Note: Please see your policy for details. Reducing cash value of a policy can increase the risk of lapse.

[Source: J.P. Morgan Asset Management analysis using data from Bloomberg]