Many employers offer life insurance for their staff, but is it all it's cracked up to be? Or would you be better off getting a personal plan catered to your needs? In this guide, we're looking at life insurance from your employer and whether it's good enough to meet your needs.

New job, new policy

So you’ve landed a brand new job, and one of the employee benefits is a life insurance policy. You always thought that getting life insurance was something you probably should do, but now it’s taken care of for you. Great stuff!

Or is it? While it might seem like a work-provided life insurance policy is something to celebrate, you might want to take a look at the documents and see just what it involves. For some people, a life insurance policy provided by your place of work does the job, but it’s usually a stripped-back version of a personal plan. How do you know if it’s right for you?

What is life insurance from your employer?

A ton of employers offer life insurance as a benefit to their team members. This is known as group life insurance because it’s the organization covering all of its employees rather than one person. More Americans are covered by group life insurance than individual plans, according to a 2017 report from the Life Insurance Marketing and Research Association. So there’s a fair few of us with this policy in place–though as you’re about to find out, that might not be the best news.

So how does a group life insurance policy work? We're glad you asked. Coverage amounts are usually capped to a certain amount, and it's unlikely you will need to take a medical exam as the policies tend to be guaranteed. If life insurance from your employer is available, signing up can be quick and easy and should be either free or fairly cost-efficient in most cases.

Just remember to name a life insurance beneficiary when you sign up; otherwise, the death benefit will go to your estate.

Pros and cons of group life insurance

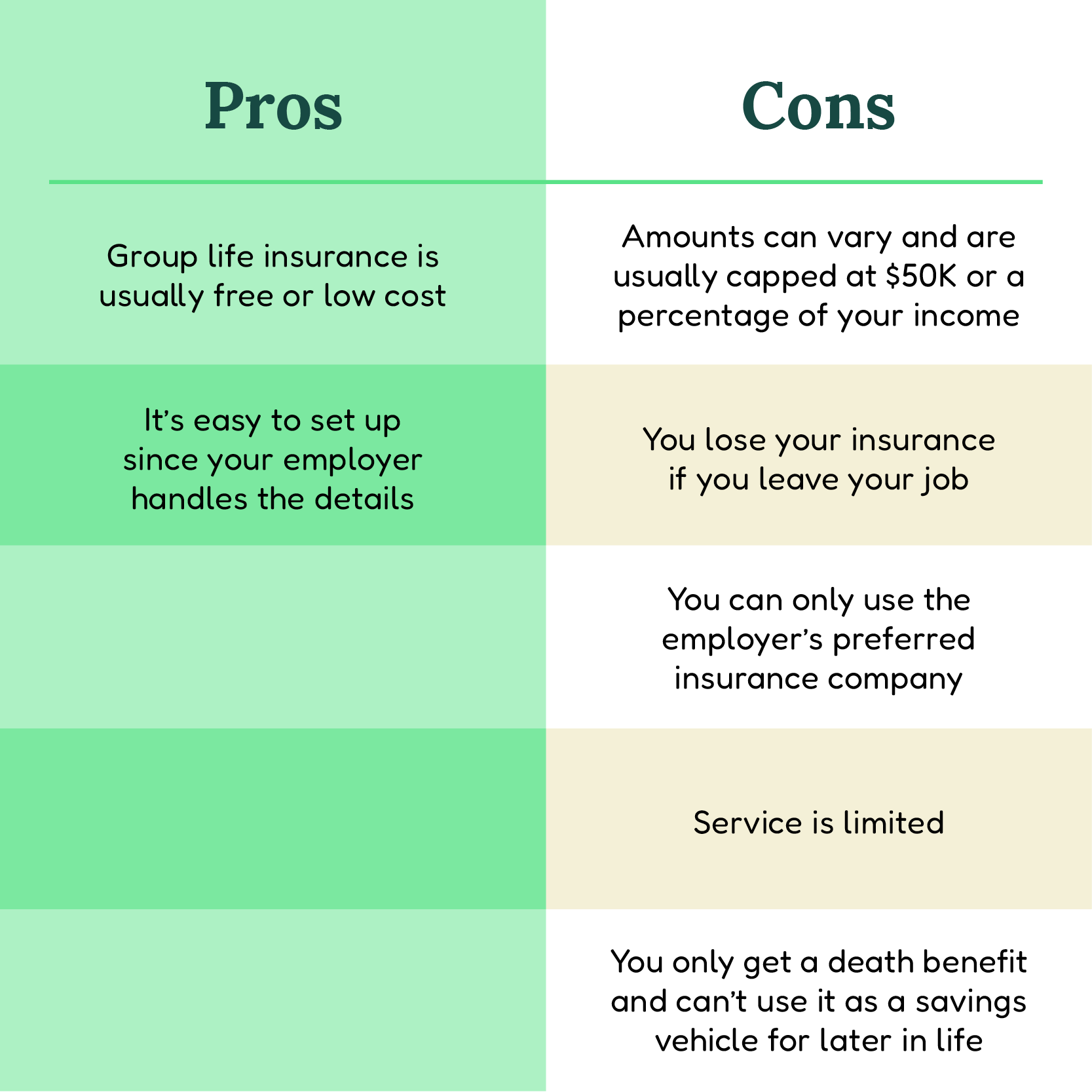

If everything sounds all fine and dandy so far, that's because it is, sort of. While a free policy guaranteed and covered by your work might seem appealing, unfortunately, it's not all roses and daisies. It’s important to know what the pros and cons are before checking life insurance off your list.

Is group life insurance right for you?

Is life insurance from your employer right for you? That depends, really. If you're young, in excellent health, and no one depends on you, then you might be able to get away with group life insurance. Then again, even if you do tick all of those boxes, a personal plan might still be needed because it offers more than a death benefit (more on that in a bit).

Group life insurance probably isn’t enough if you have a mortgage, spouse, dependents, and the other things required from adulthood. That's because the amount you're usually covered for is minimal compared to what you probably need.

Most experts suggest your policy gives you coverage for between 7 to 10 times your annual salary in order for your family to be financially stable for 7-10 years if anything happens to you. Therefore, it's unlikely a $25k or even $50k policy will be enough to give your loved ones financial security.

Not only that, work-life insurance will only payout if you die. There are other risks if you don’t die such as: what if you get sick or injured and can no longer work? Health insurance will only cover your hospital bills but they won’t pay your rent or mortgage for you if you’re unable to make an income.

So what can I do to properly protect myself?

You bet there are, namely in the form of temporary and permanent life insurance. Both are personal to you and can be tailored to meet your needs. And if you're looking to cover yourself for an amount even as high as one million dollars, a personal life insurance policy can do just that. But what's the difference between term and perm?

Term life insurance

The oldest form of life insurance going, a term policy that covers you for a set period of time–usually between 10 and 30 years. You pay into the policy during that time, and if anything happens to you, your loved ones get a death benefit when you pass.

But that's it. There are no bells and whistles attached, and if you want to renew after, say, 20 years, you'll be charged at the age when you renew and not when you first took out the policy. Term life insurance is simpler and more affordable than a perm policy and doesn't provide you with any benefits if you don’t pass during your coverage period. Term life is a good option if you’re looking for something low cost, temporary, and you’re willing to take the (likely) risk that you won’t get anything out of your policy if you pass at a ripe old age.

Permanent life insurance

All this talk of death and passing away doesn’t conjure up happy images, does it? It’s all a bit morbid, really. Fortunately, with a permanent life insurance policy, you can still focus on building–and accessing–wealth while you’re still alive. That’s because perm coverage can also act as a saving account and help you build wealth for later in life.

I’m intrigued. Tell me more about permanent life insurance

A permanent life insurance policy is so much more than just a death benefit. It accrues wealth over time and can be accessed tax-free at a later stage in life. The coverage is more expensive than a term policy, but your premiums stay the same the entire time. You will pay the same at 55 as you were at 25.

A majority of each payment goes towards a cash-saving vehicle called "cash value." This increases over time and is accessed tax-free when you want to dip into it via a loan from yourself (we'll explain in a bit). That cash value element grows on top of your original coverage, meaning both your cash value and death benefit increase together. So when you take out the cash value, you will still have a death benefit for your loved ones to receive after you pass.

Did we mention that it’s all tax-free too? That’s the sort of thing you should shout from the rooftops at least twice, especially as most savings accounts require that you pay tax on the money made. Not with a permanent policy, though. Oh no. The money you take out is entirely tax-free as you’re basically loaning from yourself– and you can’t pay yourself tax. Then, when you pass, the death benefit (which has also grown at this stage) pays off the amount you took out while still leaving a significant figure for your beneficiaries.

One more thing, you can access your death benefit any time throughout your entire life if you get severely sick or injured. That’s right, it has a built-in emergency fund that can protect you and your family from loss of income due to severe health issues at any time.

It’s quite the contrast when compared to life insurance from your employer and even term coverage. Investing in a permanent life insurance policy can provide more comprehensive protection today and set you up financially later in life.

In conclusion: What have you done for me lately?

We’re sure your employers are great, and you’ve got a job that you love. But when it comes to life insurance from your employers, it may just not be enough. Therefore it's highly recommended to consider a personal policy as early as possible in addition to your work coverage, especially if you’re looking for comprehensive coverage for whatever happens and, or you’re looking to take out extra cash from your policy later in life.