Had enough of your boss micromanaging you? Or perhaps you want to swap that job in accounting for a role in interior design? If you’re thinking of making a career change, you wouldn’t be the first and certainly won’t be the last.

About one-third of Americans consider changing their careers, with 20% taking the plunge and starting a new job. And while we’re all for encouraging you to follow your dreams–whether it’s changing jobs or running your own business–there are some things worth considering before you dive in headfirst.

One of those is what happens to life insurance when you leave a job? Many organizations provide a life insurance policy, but can you transfer it to your new role? Or should you avoid any potential issues by getting a personal life insurance policy?

Here are three things to consider with your life insurance when you’re making a career change…

First consideration: What happens to life insurance when you leave a job?

Life insurance gives you more peace of mind should the worst happen, and it can even payout while you’re still alive if you have a permanent life insurance policy, acting as a wealth-building tool.

Employers are pretty good at providing their staff with future-proofing plans, including life insurance policies.

- 67% of small firms and 97% of larger companies offer health benefits and supplemental dental benefits

- 60% of employees had access to life insurance in 2018

If you’re one of the people who have a life insurance policy at their job, you may be wondering what happens to it if you leave your position. A small selection of companies might allow you to take over the payments of your policy.

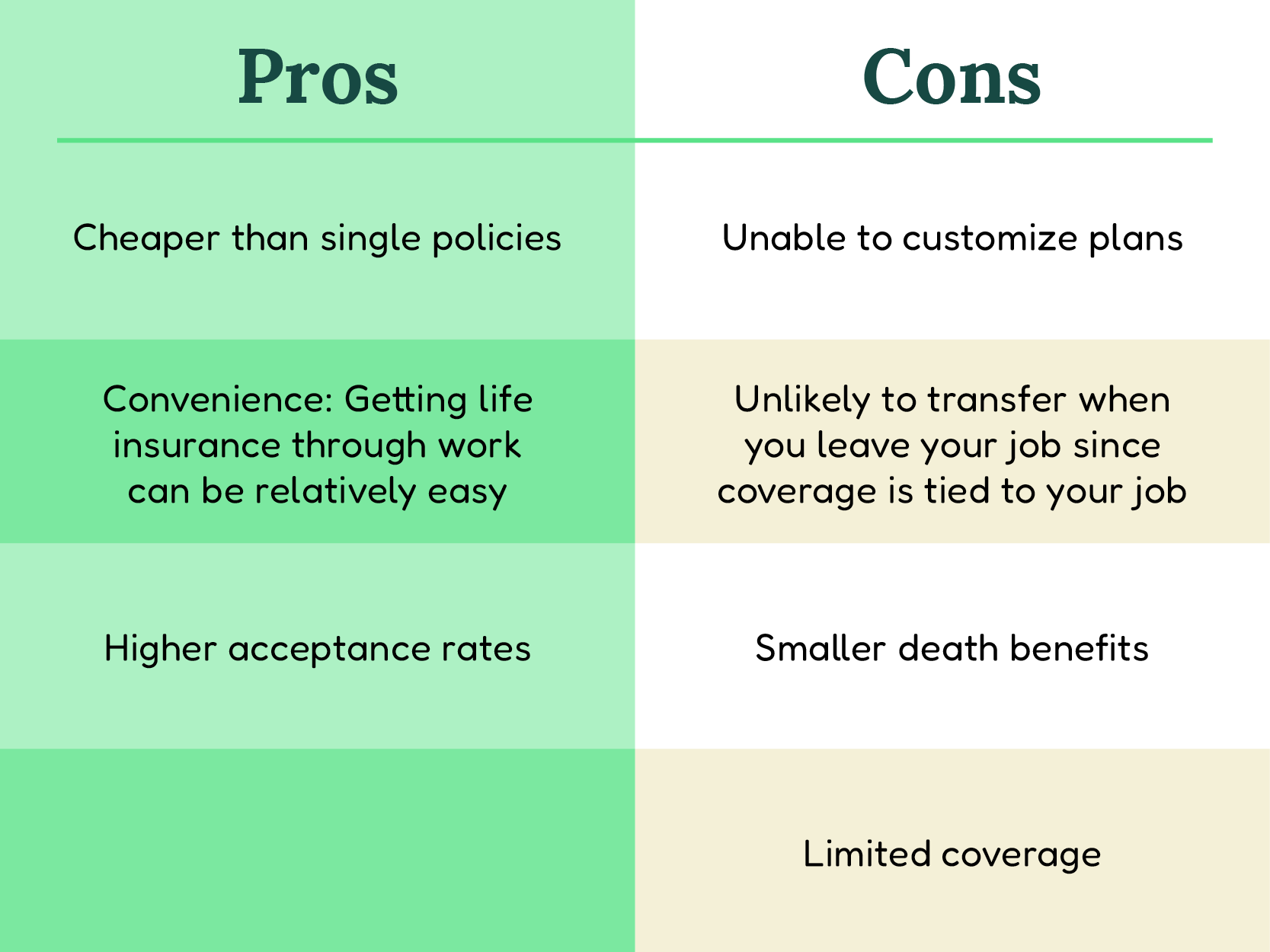

Most, however, don’t let you transfer your insurance policy, meaning everything you built up at your previous employer will become null and void. That’s because life insurance through your employer is called “group insurance” and caters to the entire workforce rather than the individual.

Pros and cons of group life insurance through your place of work

If you would like to change careers without your policy being affected and continue to build wealth despite whatever happens in life, you may want to consider getting an individual life insurance policy. You can customize a policy based on your needs and the earlier you lock in your rate, the cheaper it is for the rest of your life.

Second consideration: How to manage the transition for your savings

401k and IRAs

A 401k is another key component that will change once you switch jobs. You can rollover one 401k investment into another one with your new employer or into an IRA if you’re going down the route of self-employment.

IRAs typically offer a better variety of investment options than 401ks.. That’s because some 401ks have only a handful of funds to choose from, with many companies encouraging employees to invest in company stocks.

There are, however, drawbacks to a traditional 401K or IRA, such as income tax. Traditional 401K and IRA’s will lower your taxable income today, but will increase your it when you’re taking out the money later in life. However, if you opt to go with a Roth 401K or Roth IRA, it’s after tax money you’re investing but you won’t have to pay income taxes when you take the funds out and all your growth is tax-free.

Personal savings

Having personal savings is always a good idea if it’s possible to build up some cash reserves. It’s especially helpful if it’s taking a bit longer to look for your next gig or if there is an unexpected market downturn.

- 71% of Americans have savings

- 22% have savings of between $1,000 to $5,000

- The median savings amount is $3,500, while the mean is $26,619

Having savings is a great idea, but it’s always worth investing your money so that you can protect your future. That’s because having more than 6-12 months of savings in the bank will make your savings subject to inflation, which means you’re losing value on the money while you’re storing it away.

Third consideration: What you need to know about life insurance savings accounts

It’s easy to think about permanent life insurance as a savings account. That’s because there’s a cash-value aspect that grows over time that can be tapped into while you’re still alive. So you should always consider getting a personal policy that stays with you no matter career transitions, as it acts as a financial planning tool.

- 57% of Americans had personal life insurance in 2019

- 28% of millennials and 29% of baby boomers are happy to research and buy their policies online

- In 2018, companies issued $12,120,445 million worth of individual life policies

With a personal plan, you won’t need to worry about what happens to life insurance once you leave a job because it will stay with you the whole time. But which options should you go for?

Permanent life insurance comes with an investment benefit to your policy. The additional premiums are higher, but the policy will accrue, and you can usually borrow against it with a zero percent loan- and never have to pay it back (it’s your own money).

Best of all, it’s tax-free. Most investments–including 401k and IRAs–require you to pay tax on your earnings. Yet, you can see a permanent life insurance policy grow over time and be accessed completely tax-free.

Therefore, you can switch jobs over the years while your permanent plan is building up cash value each month. Then, in 15-20 years, you can loan the money accrued to yourself with a zero-interest loan. And because your death benefit has grown over that time, too, you’ll pay back the loan once you pass, and your beneficiaries will receive the rest.

Permanent life insurance in numbers

- 44% of policyholders owned a permanent life insurance policy, which increased from 35% in 2017

- Life insurance policy with savings (IUL and VUL products) were the fastest growing product types, VUL growing up to 54% in premiums in 2020

In conclusion: Personal life insurance can look after your future

A personal life insurance policy can help you build wealth over time and won’t be affected when you change careers. So you won’t need to ask yourself, “what happens to life insurance when you leave a job?” because it will continue regardless of your profession.

Wondering what permanent life insurance policies might be good for you? View customized options here.