Do you like paying taxes? No? Good because understanding how permanent life insurance for retirement income works to your advantage can be a game-changer for you and your tax strategy. And the best part: It keeps more of your money in your hands.

If you've landed on this page, you fit one of two profiles: You’ve just started thinking about retirement, or you’re nearing retirement age and you want to learn more about all of your options. Permanent life insurance is a great place to start.

If you fit Profile #1: Thinking about your 401k and how to get the most tax advantage with it in the future? How about investing in the market? Good—permanent life insurance can help you be tax efficient in how you spend, grow, and use your retirement income. If you’ve maxed out your other retirement options—or just want to get good diversification with your options—this is the blog for you.

If you fit Profile #2: Have you paid off your house? Have the kids moved out? In either of those scenarios, you’re probably wondering why you need life insurance since the big things you typically get life insurance for are taken care of. But the truth is, the guaranteed death benefit and tax-advantaged cash value that you can access at any time can help you with a number of your financial goals—especially as you’re getting closer to retirement. Keep reading.

Permanent Life Insurance for Retirement Income: Why It Works

Permanent life insurance policies have been a tax-efficient model for the wealthy for years. Why? Because permanent life insurance policies include certain benefits that make them a great way to diversify your portfolio and max out your tax efficiency. So whether you’re nearing retirement age or have a long time to save, here’s why you should consider permanent life insurance for retirement income:

Permanent Life Insurance for Retirement Income Benefits

#1. Grow with the market

Permanent life insurance policies have a few different models that help you from a tax standpoint: IUL and VUL. Choosing IUL allows you to grow your money in a safer, more controlled environment with a floor and a ceiling. Choosing VUL allows you to grow your money with the market while still reaping the tax-efficient benefits. And the best part is that both of these policies have guaranteed death benefits and a cash value that can be accessed tax-free.

2. Get an interest-free loan that you never have to pay back

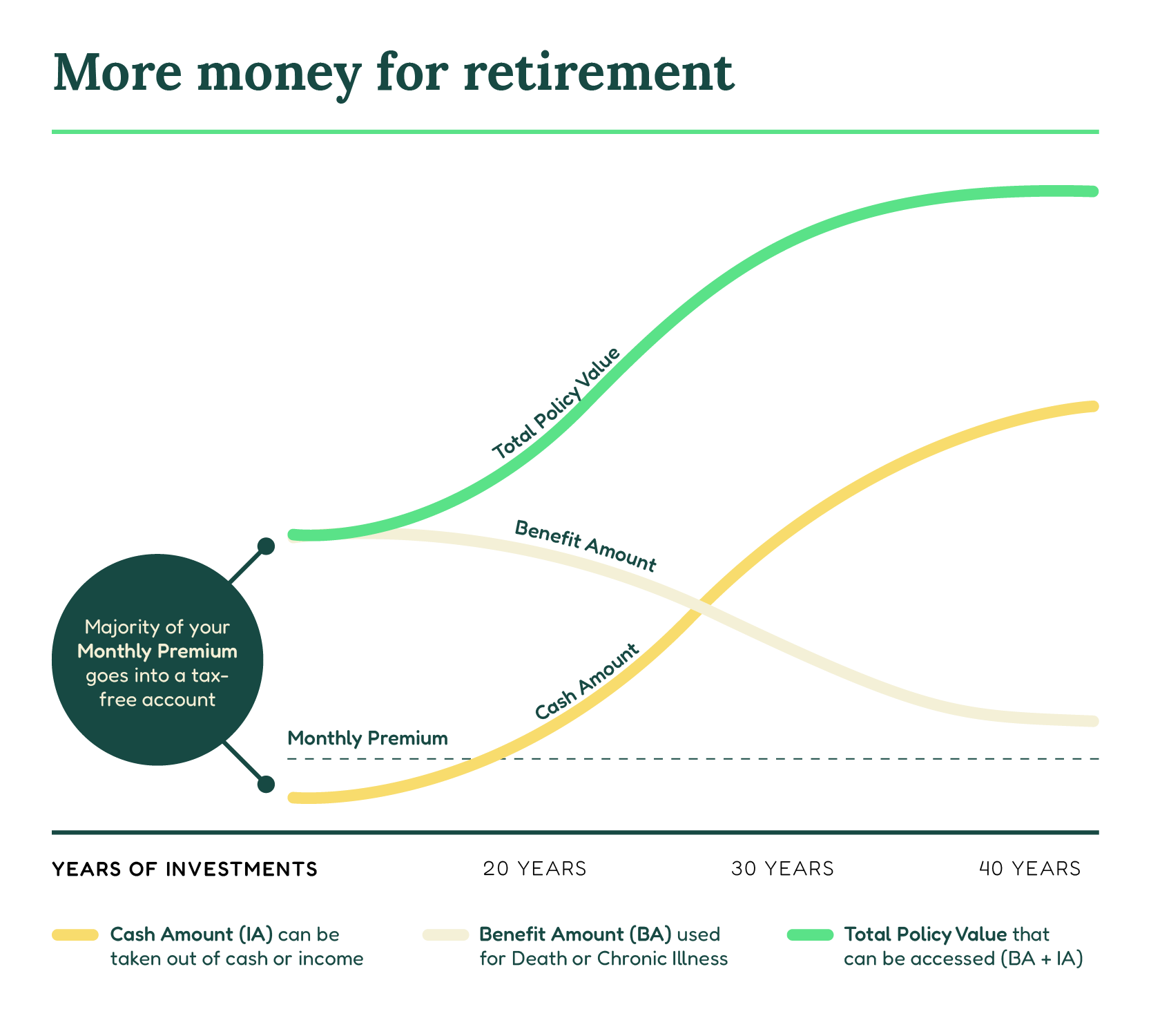

Permanent life insurance policies have a cash value you can access 10-15 years after signing your policy. This money can be accessed tax-free, and you choose whether to pay the minimum or maximum every month, giving you the freedom to grow this value on your own terms. Once those 10-15 years have passed, you can use this cash value for just about anything: A house renovation, medical expenses, a kid’s college tuition, and more. It sounds too good to be true, right? It’s not. As long as you pay your monthly premiums and keep your policy active, you can utilize this benefit.

3. Optimize your 401k

Your 401K grows tax-free, but once you tap into those resources, you do pay taxes as if it were any other kind of income. But a permanent life insurance policy is different, and you can tap into the cash value of the policy without any tax ramifications. So we propose using your permanent life insurance policy for retirement income in addition to your 401k to ensure you aren’t paying max taxes. Here’s how it works:

With a permanent life insurance policy and a 401k, you can take out half of your total amount from your 401k and half from the cash value in your life insurance policy. Why do this? Because you only get taxed for what you pull out of your 401k, and this keeps your tax bracket low while giving you the same amount of “income.”

Have questions about how this might work for you? Get in touch with one of our financial experts.

TL;DR Key Takeaway

Permanent life insurance policies aren’t just about protecting your legacy and the people you care about. They can also help protect you from spending a decent portion of your retirement income in taxes, whether you’re closer to retirement age or far from it. With a permanent life insurance policy, you can benefit from tax advantages while you’re still alive, and the younger you get a policy, the more you can benefit from the years of growth.

It’s never too early to start planning your retirement, and it’s never too early to start a permanent life insurance policy (even babies can have one). Best yet: Amplify can help you customize a policy that works for you and your goals. So, what are you waiting for? Take our 5-minute quiz to get started.